Introduction

Economics is a subject that focuses greatly on quality over quantity. It poses a shorter course than many other subjects, meaning an examiner will expect you to combine your economic theory with real life examples throughout the paper.

Choosing to focus on only microeconomics or macroeconomics is not advised. With the amount of course content being reasonable, students should cover every aspect at least once throughout the two years of the Leaving Cycle.

However, the predictions below are designed for students aiming to achieve a high grade, where, in the months leading up to the exam, they can model their own study time onto topics most likely to appear this year. Without further ado –

Predictions 2024

You may also like: Complete Guide: H1 Leaving Cert Economics Notes (New specification)

Microeconomics:

- Market Structures:

A cornerstone of the Economics course. 2022 showed oligopoly and perfect competition, with perfect competition last year. This would lead us to believe imperfect competition or monopolies are likely to show up in June.

- Elasticity:

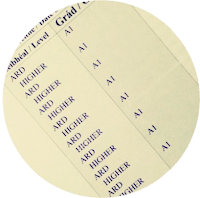

Price Elasticity of Demand is far more common than Income Elasticity of Demand. Despite appearing last year, PED still has a high probability of being asked. YED hasn’t appeared in a number of years, meaning it is very probable of popping up again. (pg 28 log tables)

- Market Failure:

This topic is asked often, but can be difficult for students to wrap their heads around. Despite appearing in a long question in 2023, we still predict market failure to appear somewhere on this year’s paper.

- Supply and Demand:

The foundations of microeconomics. Not only will these topics be questioned on specifically, with curves, factors etc., but they are also fundamental concepts in the entire Economics course. A short question is almost always devoted to either Supply or Demand curves, along with a follow up part (b), and we predict this year will be no different.

Macroeconomics:

- National Income:

The National Income chapter is one of the larger chapters on the course, meaning it is very likely to appear each year. This includes the Expenditure Method (pg 29 log tables), the Multiplier etc. The Circular Flow of Income is unlikely due to its appearance last year.

- Fiscal Policy:

A challenging topic for many, Fiscal Policy did not appear last year. In 2024, we imagine that a question on CBD/CBS, or expansionary/contractionary policy, will be asked in a long question, which will likely include real-life examples in the Irish economy.

- Inflation:

Due to its relevance in the current economic climate, CPI is likely to appear. Due to having a full-fledged long question last year, we believe in 2024, the inflation question may be limited to a short question.

- Economic Growth/Development:

With no question in 2023, this topic would be a must know for students looking to achieve high marks.

- Students will always be asked to interpret and analyse data for graphs and infographics based on the operations of the Irish economy, a skill necessary for all students as it tends to simply be relaying information

- Globalisation:

This did not appear in 2023 or 2022, meaning an appearance is expected.

- Topics such as Taxation, Labour, Employment/Unemployment and Role of Central Bank/ECB, whilst appearing last year, are still necessary to cover in depth. With the course being shorter than most, the paper tends to feature many of the same chapters every year, but in different and detailed ways.

To reiterate, these predictions are only guidelines and are not guaranteed. That being said, we hope they will steer you in the right direction to achieve top marks in Economics come June.

We wish you the best of luck in your exams!

Track record

What we predicted in 2023

Microeconomics

- A question on income elasticity of demand is highly likely to come up this year. As PED came up last year, I predict that this will be a short question with a maths element to it, so make sure you know how to use the formula.

- A Question on excess supply of goods is likely this year as a question on excess demand was a long question in 2021. I predict that this will come up as a long question, with a diagram aspect, so make sure you know how to represent excess supply on a diagram.

- As there were short questions which examined the candidates understanding of total costs and average costs last year. It is likely that there will be a short question on marginal revenue, and/or profit maximisation. If this does come up, it will more than likely be on a table format, with candidates having to work out both marginal revenue and marginal cost.

- It is very unlikely that there won’t be a question on market structures this year, given how it is the largest unit on the course. Oligopolies came up in 2021, and perfect competition/oligopolies came up in 2022, so I predict that there will be a question on monopolies, and/or monopolistic competition, with candidates having to graphically represent these two market structures.

- A question on collusion hasn’t appeared on the paper yet, so this is an important subtopic to learn as it fits nicely into any market structures question.

- For market failure: externalities came up in 2021, and 2022, so it is unlikely that this will be examined again. Instead, I would shift my attention to the other types of market failure: public goods (and their characteristics) as well as asymmetric information, and its effects on the consumer.

Macroeconomics

- The Circular flow of income has not been assessed in diagram form yet, so this could potentially be part of a national income short question, or macroeconomic long question.

- A comparison between Gross National Product and Gross Domestic Product has not been assessed yet, so I predict that this will be an aspect of a long question, with candidates having to explain the differences between them, as well as their strengths and weaknesses.

- It is highly likely that there is going to be a question which asks candidates to analyse a graph or a set of data. These are easy marks to obtain if you know how to approach the question. I would recommend candidates to follow the TTFR approach when answering these questions, that is start with the time period in the data, then assess the trends, state the figures/numbers and finally interpret why this trend has happened.

- Seeing as the concept of a budget surplus was assessed in 2021 and a budget deficit didn’t come up last year, it is likely that candidates will be assessed on the effects of a budget deficit on the economy/ the pros and cons of a budget surplus.

- Last year, there was a question on cost push inflation, making it likely that demand pull inflation will be assessed this year. I predict that demand pull inflation will be asked as a definition and what causes it – as a short question. That being said, I would be surprised if there is not a question about the rise in gas prices and electricity prices this year as this would be a nice way for the SEC to examine candidates understanding of the topic, while linking it to topical affairs. Therefore I predict that a question on the rise of electricity and gas prices, will be assessed as part of a long question this year.

- A question on the topic of monetary policy has not come up before, so this would be on my priority list for this examination.

- There wasn’t a question on LDCs or overseas aid last year, so it would be likely for this to appear on the paper this year. In this topic, there hasn’t been a question on pros/cons of overseas aid or on the different types of economic aid, so I would learn these two topics well for the exam, as they can either appear as short questions or as an aspect of a long question on economic development/globalisation.

- There was no question on globalisation last year [read our free sample chapter on Globalisation here], so I predict that this will be assessed as a long question, possibly with economic aid as well. This can be assessed as both a short question and a long question, so I would prioritise this topic for macroeconomics.

- Arguments in favour of trade/ fair trade haven’t come up yet, this would be a likely topic to come up as a short question, possibly with an analytical question on trade.

- Remember, there will always be some topical questions on the economics exams, for example last year there was a question on the new minimum wage and minimum unit pricing for alcohol. This year, I predict that there will be a question on rising energy prices, possibly a question on the FIFA world Cup (with a trade/demand aspect linked into it). I advise every candidate to keep up with current events, especially those regarding the economy, by listening to the Economist podcast or by simply reading a newspaper article now and then.

- All the best for the exam, and remember you know more economics than you think, use your intuition and link the theory to real world applications, this is how you succeed!

Leaving Cert Economics Notes: The Government And The Economy – Fiscal Policy